EN BANC

[ G.R. No. 226680. August 30, 2022 ]

ACES PHILIPPINES CELLULAR SATELLITE CORPORATION, PETITIONER, VS. THE COMMISSIONER OF INTERNAL REVENUE, RESPONDENT

SEPARATE CONCURRING AND DISSENTING OPINION

DIMAAMPAO, J.:

"[E]very person surrenders a portion of their income for the running of the government, and the government in turn, provides tangible and intangible benefits to serve and protect those within its jurisdiction."1 This describes the benefits-received principle in taxation.

The instant Petition calls upon the Court to settle a novel question of law: is income paid to a foreign corporation for satellite services it provides subject to taxation in our jurisdiction?

The ponencia answers this issue in the affirmative based on a close examination of the ACeS System as described in the Air Time Purchase Agreement executed between Aces Philippines Cellular Satellite Corporation (petitioner) and Aces International Limited, the foreign corporation incorporated in Bermuda (Aces Bermuda).

Although I agree with this conclusion, I believe that the ponencia should have also scrutinized the instant case in light of the relevant principles laid down by the Court in the very recent case of Saint Wealth Ltd. v. Bureau of Internal Revenue,2 where our traditional rules on recognizing the source of income was applied to the economic activities of Philippine Offshore Gaming Operators (POGOs).

Indeed, an identical level of complex innovativeness attends the present query, and Our decision would have far-reaching implications to other parties and transactions similarly-situated.

In Saint Wealth, the Court was tasked with properly assessing the taxability of an unprecedented situation: POGOs providing and participating in offshore gaming services. There, the Court undertook to carefully analyze how the POGOs operated and how they derived revenues. The Court's eventual conclusion found its legal mooring under Section 42 (A)3 of the National Internal Revenue Code (Tax Code), as amended by Republic Act No. 8424,4 and from the seminal cases of Commissioner of Internal Revenue v. British Overseas Airways Corporation (BOAC)5 and Commissioner of Internal Revenue v. Baier-Nickel.6

The Court ratiocinated that the POGOs derived no income from sources within the Philippines "because the 'activity' which produces income occurs and is located outside the territory of the Philippines. Indeed, the flow of wealth or the income-generating activity-the placing of bets less the amount of payout - transpires outside the Philippines."7 Thus, the POGOs, by the very nature of their operations and limited presence, could not have been said to enjoy any protection from the State as to justify their taxation in this jurisdiction.

This was the necessary outcome of applying the prevailing situs rules embodied in Our Tax Code. The Court recognized this inherent statutory limitation in the State's current ability to exact taxes when it observed that "until such time as existing tax treaties and tax laws are revised and revisited to account for the digital economy, this Court must apply the laws as they currently are. Since, as explained above, no income is derived from sources within the Philippines, offshore-based POGO licensees cannot be subjected to income tax."8

From the foregoing, the question devolves to whether the same principles should apply to Aces Bermuda's satellite services.1aшphi1 To my mind, they do not.

At first blush, the services provided by Aces Bermuda do seem to present the same issues that arose from the incorporeality of the POGO transactions rendered in the digital economy. It cannot be gainsaid that when the movement of products or services are neither tangible nor visible, there is a layer of added complexity in pinpointing precisely where the business activity which produces the taxable income occurs. This was precisely the challenge that the Court hurdled in arriving at its ruling in Saint Wealth. however, the apparent nonphysical form of the services rendered by both Aces Bermuda and the POGOs is where the similarities of the two end. As will be extensively discussed below, the present case presents a key distinction that exists by the very nature of how satellite radio signals are utilized which sets it apart from transactions conducted over the internet and which call upon a different conclusion from this Court.

The revenue-generating activity occurs within the Philippines.

The "source" of income is not determined by where the payout is either disbursed or physically received but rather where the business activity that produced the same was actually conducted.9 Moreover, in cases where the transaction occurs in multiple stages spanning different taxing jurisdictions, it becomes imperative to determine whether particular stages occurring in the Philippines are so integral to the transaction as a whole that the business activity would not be accomplished without it. In such instances, the foreign corporation would clearly need to rely on the State to produce its income, which is the very tenet of the benefits-received theory.

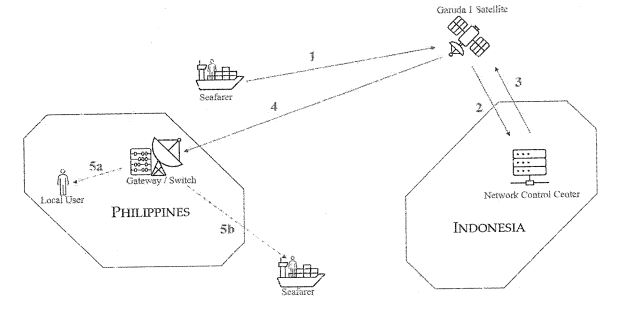

Here, it was keenly observed by the ponencia that the performance of the service in this case does not cease at the point of transmission but continues until Aces Bermuda successfully delivers the satellite communication time to the petitioner's gateways. This is further underscored by the parties' own Air Time Purchase Agreement whereby petitioner is only charged based on usage but excludes therefrom satellite utilization time for call set-up, unanswered calls, and incomplete calls. Interestingly, the last two situations presuppose that air time was transmitted from Aces Bermuda and yet by the terms of their contract, petitioner would not be liable for these. This contradicts petitioner's assertion that Aces Bermuda's provided services cease from transmission. Clearly, a complete and successful delivery of air time between and among end users or Philippine subscribers is the anchor of the revenue-generating business activity. Without which, there would be no "inflow of economic benefits" as advanced by the ponencia. This is better appreciated when the ACeS System is illustrated: 10

ACeS Svstem

To my mind, and as portrayed in the illustration above, the receipt of the satellite air time by petitioner's gateways and the actual utilization thereof by the Philippine subscribers, whether or not they are found locally or are seafarers in the high seas as claimed by petitioner, are the very core of Aces Bermuda's services. Whether intentionally or unintentionally, Aces Bermuda relies on the State's facilities to pursue its commercial interests. Hence, it cannot disclaim the surrender of a portion of its income in exchange for the State's protection.1aшphi1

As above-intimated, this distinguishes the instant case from that presented in Saint Wealth. In the afore-cited case, the core stage of the business activity conducted by the POGOs, i.e., the placing of bets less the amount of payout, occurred outside of the Philippines. Hence, there was no basis to impose taxes. This is contra-distinguished in the present case where the receipt of the satellite air time and the eventual successful utilization of the same by end-users is the very trigger for petitioner's payment of fees to Aces Bermuda.

All in all, Aces Bermuda cannot evade its tax liabilities. By extension, petitioner, having failed to withhold the appropriate taxes, is directly liable for the same as a withholding agent.

As aptly observed by the ponencia, there is some merit in the petitioner's contention that it should not be held liable simultaneously for deficiency and delinquency interest.

To be sure, prior to the 2018 amendment to the Tax Code, the wording of Section 249 thereof supported the practice of imposing both deficiency and delinquency interest until the taxes due were paid in full.

As the ponencia observes, one of the changes introduced by Republic Act No. 10963,11 or the Tax Reform for Acceleration and Inclusion (TRAIN) Act is to halt the hemorrhaging of interest on tax liabilities by proscribing the simultaneous application of deficiency and delinquency interest, to wit:

SEC. 249. Interest. -

(A) In General. - There shall be assessed and collected on any unpaid amount of tax, interest at the rate of double the legal interest rate for loans or forbearance of any money in the absence of an express stipulation as set by the Bangko Sentral ng Pilipinas from the date prescribed for payment until the amount is fully paid: Provided, That in no case shall the deficiency and the delinquency interest prescribed under Subsections (B) and (C) hereof, be imposed simultaneously. (Emphases and underscoring supplied)

It is readily apparent in the minutes of the Bicameral Conference Committee Hearings for the disagreeing provisions to the precursor bills to the TRAIN Act, i.e., House Bill No. 5636 and Senate Bill No. 1592, that Congress expressly adopted this prohibition as a concession to taxpayers, to wit:

CHAIRPERSON CUA. May I present a proposal from the industry.

CHAIRPERSON ANGARA. For which provision? Is it for the current provision?

CHAIRPERSON CUA. Yeah, for the current provision.xx x

x x x x

CHAIRPERSON CUA. They also propose expressly to prohibit the simultaneous imposition of deficiency and delinquency interest.

CHAIRPERSON ANGARA. That's acceptable to the BIR? MR. CHUA. (Nodding) CHAIRPERSON ANGARA. Subject to style, yes. I think that has been a complaint put that on top of the other. Thank you.

CHAIRPERSON CUA. Thank you, Mr. Chairman.12

Indeed, even the Department of Finance conceded that the interest regime under TRAIN was made "fairer and simpler" in order to encourage taxpayers to pay their taxes.13 It recognized the stark reality that prior to this amendment, taxpayers could end up paying accumulated interest penalties which exceeded the amount of the basic deficiency tax.14

Clearly, the amendment to Section 249 is a form of remedial legislation which the Court should apply in every opportunity, as in this case.

In applying the same to the present case, We must be guided by Revenue Regulation No. 21-2018, which implements the amendment to Section 249. Section 6 thereof provides:

Section 6. TRANSITORY PROVISIONS. - In cases where the tax liability/ies or deficiency tax/es became due before the effectivity of the TRAIN Law on January 1, 2018, and where the full payment thereof will only be accomplished after the said effectivity date, the interest rates shall be applied as follows:

| Period |

Applicable Interest Type and Rate |

| For the period up to December 31 , 2017 |

Deficiency and / or delinquency interest at 20% |

| For the period January 1 , 2018 until full payment of the tax liability |

Deficiency and / or delinquency interest at 12% |

The double imposition of both deficiency and delinquency interest under Section 249 prior to its amendment will still apply in so far as the period between the date prescribed for payment until December 31, 2017

x x x x

Accordingly, the assailed rulings of the Court of Tax Appeals En Banc were correctly modified by the ponencia when it held that petitioner should only be ordered to pay the basic final withholding tax due with simultaneous deficiency and delinquency of twenty percent (20%) per annum thereon computed from 10 January 2007 until 31 December 2017. Thereafter, only delinquency interest at the rate of twelve percent (12%) per annum shall accrue, computed from 1 January 2018, which is the effectivity date of the TRAIN Act, until full payment.

In the interest of equity, the imposition of surcharge should be deleted.

Anent the imposition of surcharge, it is my considered opinion that the same must be deleted. Generally, surcharges are paid to penalize the taxpayer's non-filing or improper filing of returns or non-payment of taxes due. Here, the surcharge was imposed based on Section 248 (3) of the Tax Code for petitioner's "[f]ailure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment."

In the past, this Court limited the deletion of the surcharges imposed to instances when the taxpayer's "good faith" was grounded on the Bureau of Internal Revenue (BIR)'s previous erroneous interpretations of the law.15 In Philippine Amusement and Gaming Corp. (PAGCOR) v. The Commissioner of Internal Revenue, et al.,16 We sustained the imposition of surcharge considering that the therein taxpayer's "good faith" was based solely on "opinions of the Office of the Government Corporate Counsel, and the [Office of the Solicitor General] and the Resolutions issued by the Department of Justice" which were government offices bereft of any authority to implement or interpret tax laws.

However, these previous cases did not present the same complexity or novelty as entailed in the present Petition. As the ponencia summarized, the petitioner here relied on (1) BIR Ruling No. ITAD-214-02; (2) Commissioner of Internal Revenue v. Piedras Negras Broadcasting decided by the US Circuit Court of Appeals, as well as other cases decided in India, Singapore, Thailand, and Germany; (3) Section 863(e) of the US Internal Revenue Code; and (4) OECD Commentaries on Article 5 of the Model Tax Convention on Income and on Capital.17 Concededly, none of these references are binding in this jurisdiction and the BIR Ruling relied upon was issued in favor of a different taxpayer.

Nevertheless, since the taxability of income from satellite services has never been passed upon by this Court and the provisions of the Tax Code, particularly the sections on income tax and situs of taxation, are silent with respect to the treatment of this particular form of revenue, the petitioner's liability to income tax is a difficult question of law and an admitted gray area prior to the promulgation of this Decision. Indeed, petitioner was constrained to rely upon how similar services were treated in other jurisdictions, particularly the U.S. from which our Tax Code was originally drawn from. The similarity in the tax treatment of similar services across multiple jurisdictions supported petitioner's honest belief that the payments it made to Aces Bermuda were not subject to tax.

With all due respect to the majority, I believe it is of no moment that petitioner failed to raise the issue on the imposition of the surcharge before the CTA. Indeed, as a general rule, the Court may not pass upon issues not raised before the trial court lest We offend the other party's right to due process.18 Nevertheless, this rule admits of exceptions such as when the matter not assigned as an error is closely related to another error that was assigned, or when the resolution thereof is necessary in arriving at a just decision and complete resolution of the case or to serve the interests of justice, as in this case.19Undoubtedly, the issue on petitioner's liability for surcharge is closely related to its ultimate tax liability. Moreover, and as above-discussed, this point of law has never been passed upon by the Court and this necessitates that We temper petitioner's liability to cushion the blow as it were, especially since it had colorable basis for believing that it was not subject to tax for its transactions.

Undoubtedly, it is within the power of the Court to temper penalties on the basis of good faith and honest belief.20 I believe the current situation merits the same exercise of equity.

With the foregoing discourse, I vote to partly grant the Petition.

Footnotes

1 Saint Wealth Ltd. v. Bureau of Internal Revenue, et. al., G.R. Nos. 252965 & 254102, 7 December 2021.

2 Id.

3 Section 42. Income from Sources Within the Philippines.-

(A) Gross Income Fr.om Sources Within the Philippines. - The following items of gross income shall be treated as gross income from sources within the Philippines:

x x x x

(3) Services. - Compensation for labor or personal services performed in the Philippines;

x x x x

4 TAX REFORM ACT OF 1997, enacted on 11 December 1997.

5 233 Phil. 406-438 (I 987).

6 531 Phil. 480-496 (2006).

7 Supra note I.

8 Id.

9 Supra note I.

10 Note: The simplified illustration is based on the diagram submitted by petitioner and as described in the pleadings and the records; it was prepared using the stock clip arts provided in Microsoft Word (see rollo, p. 562).

11 Approved on 19 December 2017.

12 Minutes of the Bicameral Conference Committee Meeting on the Disagreeing Provisions of H.B. No. 5636 and S.8. No. 1592 on 5 December 2017, pp. EMTB / XYIII-3 to XVIII-4

13 "TRAIN removes oppressive rates for delinquent tax payments." Department of Finance, posted on 14 February 2018. Accessed at

14 Id.

15 See Thunderbird Pilipinas Hotels and Resorts, Inc. v. Commissioner of Internal Revenue, G.R. No. 211327, 11 November 2020.

16 821 Phil. 508-537(2017).

17 Ponencia, p. 26.

18 See Figuera v. Ang, 788 Phil. 607-621 (2016).

19 Id.

20 See Film Development Council of the Philippines v. Colon Heritage Realty Corp., G.R. Nos. 203754 & 204418 (Resolution), 15 October 2019, 923 SCRA 583-603.

The Lawphil Project - Arellano Law Foundation