G.R. No. 207246, November 22, 2016,

♦ Decision,

Caguioa, [J]

♦ Concurring Opinion,

Sereno, [CJ]

♦ Concurring Opinion,

Velasco, [J]

♦ Concurring Opinion,

Bersamin, [J]

♦ Separate and Dissenting Opinion,

Carpio, [J]

♦ Dissenting Opinion,

Mendoza, [J]

♦ Dissenting Opinion,

Leonen, [J]

EN BANC

[ G.R. No. 207246. November 22, 2016 ]

JOSE M. ROY III, PETITIONER, VS. CHAIRPERSON TERESITA HERBOSA, THE SECURITIES AND EXCHANGE COMMISSION, AND PHILILIPPINE LONG DISTANCE TELEPHONE COMPANY, RESPONDENTS.

WILSON C. GAMBOA, JR., DANIEL V. CARTAGENA, JOHN WARREN P. GABINETE, ANTONIO V. PESINA, JR., MODESTO MARTIN Y. MAMON III, AND GERARDO C. EREBAREN, PETITIONERS-IN-INTERVENTION,

PHILIPPINE STOCK EXCHANGE, INC., RESPONDENT-IN-INTERVENTION,

SHAREHOLDERS' ASSOCIATION OF THE PHILIPPINES, INC., RESPONDENT-IN-INTERVENTION.

DISSENTING OPINION

LEONEN, J.:

I dissent from the Decision denying the Petition. Respondent Securities and Exchange Commission's Memorandum Circular No. 8, series of 2013 is inadequate as it fails to encompass each and every class of shares in a corporation engaged in nationalized economic activities. This is in violation of the constitutional provisions limiting foreign ownership in certain economic activities, and is in patent disregard of this Court's statements in its June 28, 2011 Decision1 as further illuminated in its October 9, 2012 Resolution2 in Gamboa v. Finance Secretary Teves. Thus, the Securities and Exchange Commission gravely abused its discretion.

A better considered reading of both the 2011 Decision and 2012 Resolution in Gamboa demonstrates this Court's adherence to the rule on which the present Decision turns: that the 60 per centum (or higher, in the case of Article XII, Section 10) Filipino ownership requirement in corporations engaged in nationalized economic activities, as articulated in Article XII and Article XIV3 of the 1987 Constitution, must apply "to each class of shares, regardless of differences m voting rights, privileges and restrictions[.]"4

The 2011 Decision and 2012 Resolution in Gamboa concededly lend themselves to some degree of confusion. The dispositive portion in the 2011 Decision explicitly stated that "the term 'capital' in Section 11, Article XII of the 1987 Constitution refers only to shares of stock entitled to vote in the election of directors[.]"5 The 2012 Resolution, for its part, fine-tuned this. Thus, it clarified that each class of shares, not only those entitled to vote in the election of directors, is subject to the Filipino ownership requirement.6 However, the 2012 Resolution did not recalibrate the 2011 Decision's dispositive portion inclusive of its definition of "capital." Rather, it merely stated that the motions for reconsideration were denied with finality and that no further pleadings shall be allowed.7

Nevertheless, a judgment must be read in its entirety; in such a manner as to bring harmony to all of its parts and to facilitate an interpretation that gives effect to its entire text. The brief statement in the dispositive portion of the 2012 Resolution that the motions for reconsideration were denied was not inconsistent with the jurisprudential fine-tuning of the concept of "capital." Neither was it inadequate; it succinctly stated the action taken by the court on the pending incidents of the case. The dispositive portion no longer needed to pontificate on the concept of "capital," for all that it needed to state to dispose of the case, at that specific instance was that the motions for reconsideration had been denied.1aшphi1

The brevity of the 2012 Resolution's dispositive portion was certainly not all that there was to that Resolution. The Court's having promulgated an extended resolution (as opposed to the more commonplace minute resolutions issued when motions for reconsideration raise no substantial arguments or when the Court's prior decision or resolution on the main petition had already passed upon all the basic issues) is telling. It reveals that the Court felt it necessary to engage anew in an extended discussion because matters not yet covered, needing greater illumination, warranting recalibration, or impelling fine-tuning, were then expounded on. This, even if the ultimate juridical result would have merely been the denial of the motions for reconsideration. It would be a disservice to the Court's own wisdom then, if attention was to be drawn solely to the disposition denying the motions for reconsideration, while failing to consider the rationale for that denial.

This position does not violate the doctrine on immutability of judgments. The Gamboa ruling is not being revisited or re-evaluated in such a manner as to alter it. Far from it, this position affirms and reinforces it. In resolving the validity of the Securities and Exchange Commission's Memorandum Circular No. 8, this position merely echoes the conception of capital already articulated in Gamboa; it does not invent an unprecedented idea. This echoing builds on an integrated understanding, rather than on a myopic or even isolationist emphasis on a matter that the dispositive portion no longer even needed to state.

In any case, the present Petition does not purport or sets itself out as a bare continuation of Gamboa. If at all, it accepts Gamboa as a settled matter, a fait accompli; and only sets out to ensure that the matters settled there are satisfied. This, then, is an entirely novel proceeding precipitated by a distinct action of an instrumentality of government that, as the present Petition alleges, deviates from what this Court has put to rest.

Memorandum Circular No. 8, an official act of the Securities and Exchange Commission, suffices to trigger a justiciable controversy. There is no shortage of precedents (e.g., Province of North Cotabato, et al. v. Government of the Republic of the Philippines Peace Panel on Ancestral Domain (GRP), et al.,8 Imbong v. Ochoa, Jr.,9 and Disini, Jr., et al. v. The Secretary of Justice, et al.10) in which this Court appreciated a controversy as ripe for adjudication even when the trigger for judicial review were official enactments which supposedly had yet to occasion an actual violation of a party's rights. Province of North Cotabato is on point:

The Solicitor General argues that there is no justiciable controversy that is ripe for judicial review in the present petitions, reasoning that

The unsigned MOA-AD is simply a list of consensus points subject to further negotiations and legislative enactments as well as constitutional processes aimed at attaining a final peaceful agreement. Simply put, the MOA-AD remains to be a proposal that does not automatically create legally demandable rights and obligations until the list of operative acts required have been duly complied with. xxx

xxx xxx xxx

In the cases at bar, it is respectfully submitted that this Honorable Court has no authority to pass upon issues based on hypothetical or feigned constitutional problems or interests with no concrete bases. Considering the preliminary character of the MOA-AD, there are no concrete acts that could possibly violate petitioners' and intervenors' rights since the acts complained of are mere contemplated steps toward the formulation of a final peace agreement. Plainly, petitioners and intervenors' perceived injury, if at all, is merely imaginary and illusory apart from being unfounded and based on mere conjectures....

. . . .

The Solicitor General's arguments fail to persuade.

Concrete acts under the MOA-AD are not necessary to render the present controversy ripe. In Pimentel, Jr. v. Aguirre, this Court held:

x x x [B]y the mere enactment of the questioned law or the approval of the challenged action, the dispute is said to have ripened into a judicial controversy even without any other overt act. Indeed, even a singular violation of the Constitution and/or the law is enough to awaken judicial duty.

xxx xxx xxx

By the same token, when an act of the President, who in our constitutional scheme is a coequal of Congress, is seriously alleged to have infringed the Constitution and the laws x x x settling the dispute becomes the duty and the responsibility of the courts.

In Santa Independent School District v. Doe, the United States Supreme Court held that the challenge to the constitutionality of the school's policy allowing student-led prayers and speeches before games was ripe for adjudication, even if no public prayer had yet been led under the policy, because the policy was being challenged as unconstitutional on its face.

That the law or act in question is not yet effective does not negate ripeness. For example, in New York v. United States, decided in 1992, the United States Supreme Court held that the action by the State of New York challenging the provisions of the Low-Level Radioactive Waste Policy Act was ripe for adjudication even if the questioned provision was not to take effect until January 1, 1996, because the parties agreed that New York had to take immediate action to avoid the provision's consequences.11 (Underscoring and citations omitted)

The Court, here, is called to examine an official enactment that supposedly runs afoul of the Constitution's injunction to "conserve and develop our patrimony,"12 and to "develop a self-reliant and independent national economy effectively controlled by Filipinos."13 This allegation of a serious infringement of the Constitution compels us to exercise our power of judicial review.

A consideration of the constitutional equity requirement as applying to each and every single class of shares, not just to those entitled to vote for directors in a corporation, is more in keeping with the "philosophical underpinning"14 of the 1987 Constitution, i.e., "that capital must be construed in relation to the constitutional goal of securing the controlling interest in favor of Filipinos."15

No class of shares is ever truly bereft of a measure of control of a corporation. It is true, as Section 616 of the Corporation Code permits, that preferred and/or redeemable shares may be denied the right to vote extended to other classes of shares. For this reason, they are also often referred to as 'non-voting shares.' However, the absolutist connotation of the description "non-voting" is misleading.1aшphi1 The same Section 6 provides that these "non voting shares" are still entitled to vote on the following matters:

1. Amendment of the articles of incorporation;

2. Adoption and amendment of by-laws;

3. Sale, lease, exchange, mortgage, pledge or other disposition of all or substantially all of the corporate property;

4. Incurring, creating or increasing bonded indebtedness;

5. Increase or decrease of capital stock;

6. Merger or consolidation of the corporation with another corporation or other corporations;

7. Investment of corporate funds in another corporation or business in accordance with this Code; and

8. Dissolution of the corporation.

In the most crucial corporate actions - those that go into the very constitution of the corporation - even so-called non-voting shares may vote. Not only can they vote; they can be pivotal in deciding the most basic issues confronting a corporation. Certainly, the ability to decide a corporation's framework of governance (i.e., its articles of incorporation and by-laws), viability (through the encumbrance or disposition of all or substantially all of its assets, engagement in another enterprise, or subjection to indebtedness), or even its very existence (through its merger or consolidation with another corporate entity, or even through its outright dissolution) demonstrates not only a measure of control, but even possibly overruling control. "Nonvoting" preferred and redeemable shares are hardly irrelevant in controlling a corporation.

It is in this light that I emphasize the necessity, not only of legal title, but more so of full beneficial ownership by Filipinos of the required percentage of capital in certain corporations engaged in nationalized economic activities. This has been underscored in Gamboa. This too, is a matter, which I emphasized in my Dissenting Opinion in the Narra Nickel and Development Corp. v. Redmont Consolidated Mines Corp17 April 21, 2014 Decision.

I likewise emphasize "the [C]ontrol [T]est as a primary method of determining compliance with the restrictions imposed by the Constitution on foreign equity participation,"18 along with a recognition of the Grandfather Rule as a "supplement"19 to the Control Test.

My Dissent from the April 21, 2014 Decision in Narra Nickel, noted that "there are two (2) ways through which one may be a beneficial owner of securities, such as shares of stock: first, by having or sharing voting power; and second, by having or sharing investment returns or power."20 This is gleaned from the definition of "beneficial owner or beneficial ownership" provided for in the Implementing Rules and Regulations of the Securities Regulation Code.21

Full beneficial ownership vis-a-vis capacity to control a corporation is self-evident in ownership of voting stocks: the investiture of the capacity to vote evinces involvement in the running of the corporation. Through it, a stockholder participates in corporate decision-making, or otherwise participates in the designation of directors - those individuals tasked with overseeing the corporation's activities.

Appreciating full beneficial ownership and control in a corporation may require a more nuanced approach when the subject of inquiry is investment returns or power. Control through the capacity to vote can be countervailed, if not totally negated, by reducing voting shares to empty shells that represent nominal ownership even as the corporation's economic gains actually redound to the holders of other classes of shares. There exist practices such as corporate layering which, can be used to undermine the Constitution's equity requirements.

It is in the spirit of ensuring that effective control is lodged in Filipinos that the dynamics of applying the Control Test and the Grandfather Rule must be considered.

As I emphasized in my twin dissents in the Narra Nickel April 21, 2014 Decision and January 28, 2015 Resolution,22 with the 1987 Constitution's silence on the specific mechanism for reckoning Filipino and foreign equity ownership in corporations, the Control Test - statutorily established through Republic Act No. 8179, the Foreign Investments Act "must govern in reckoning foreign equity ownership in corporations engaged in nationalized economic activities."23 Nevertheless, "the Grandfather Rule may be used ... as a further check to ensure that control and beneficial ownership of a corporation is in fact lodged in Filipinos."24

The Control Test was established by legislative fiat. The Foreign Investments Act "is the basic law governing foreign investments in the Philippines, irrespective of the nature of business and area of investment."25 Its Section 3(a) defines a "Philippine national" as including "a corporation organized under the laws of the Philippines of which at least sixty per cent (60%) of the capital stock outstanding and entitled to vote is owned and held by citizens of the Philippines[.]" In my Dissent in the Narra Nickel April 21, 2014 Decision:

This is a definition that is consistent with the first part of paragraph 7 of the 1967 SEC Rules, which [originally articulated] the Control Test: "[s]hares belonging to corporations or partnerships at least 60 per cent of the capital of which is owned by Filipino citizens shall be considered as of Philippine nationality."26

The Control Test serves the purposes of ensuring effective control and full beneficial ownership of corporations by Filipinos, even as several corporations may be involved in the equity structure of another. As I explained in my Dissent from the April 21, 2014 Decision in Narra Nickel:

It is a matter of transitivity that if Filipino stockholders control a corporation which, in turn, controls another corporation, then the Filipino stockholders control the latter corporation, albeit indirectly or through the former corporation.

An illustration is apt.

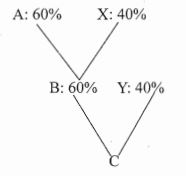

Suppose that a corporation, "C", is engaged in a nationalized activity requiring that 60% of its capital be owned by Filipinos and that this 60% is owned by another corporation, "B", while the remaining 40% is owned by stockholders, collectively referred to as "Y". Y is composed entirely of foreign nationals. As for B, 60% of its capital is owned by stockholders collectively referred to as "A", while the remaining 40% is owned by stockholders collectively referred to as "X". The collective A, is composed entirely of Philippine nationals, while the collective X is composed entirely of foreign nationals. (N.b., in this illustration, capital is understood to mean "shares of stock entitled to vote in the election of directors," per the definition in Gamboa). Thus:

By owning 60% of B's capital, A controls B. Likewise, by owning 60% of C's capital, B controls C. From this, it follows, as a matter of transitivity, that A controls C; albeit indirectly, that is, through B.

This "control" holds true regardless of the aggregate foreign capital in B and C. As explained in Gamboa, control by stockholders is a matter resting on the ability to vote in the election of directors:

Indisputably, one of the rights of a stockholder is the right to participate in the control or management of the corporation. This is exercised through his vote in the election of directors because it is the board of directors that controls or manages the corporation.

B will not be outvoted by Y in matters relating to C, while A will not be outvoted by X in matters relating to B. Since all actions taken by B must necessarily be in conformity with the will of A, anything that B does in relation to C is, in effect, in conformity with the will of A. No amount of aggregating the foreign capital in B and C will enable X to outvote A, nor Y to outvote B.

In effect, A controls C, through B. Stated otherwise, the collective Filipinos in A, effectively control C, through their control of B.27 (Emphasis in the original)

Full beneficial ownership is addressed both with respect to voting power and investment returns or power.

As I explained, on voting power:

Voting power, as discussed previously, ultimately rests on the controlling stockholders of the controlling investor corporation. To go back to the previous illustration, voting power ultimately rests on A, it having the voting power in B which, in tum, has the voting power in C.28

As I also explained, on investment returns or power:

As to investment returns or power, it is ultimately A which enjoys investment power. It controls B's investment decisions including the disposition of securities held by B and (again, through B) controls C's investment decisions.

Similarly, it is ultimately A which benefits from investment returns generated through C. Any income generated by C redounds to B's benefit, that is, through income obtained from C, B gains funds or assets which it can use either to finance itself in respect of capital and/or operations. This is a direct benefit to B, itself a Philippine national. This is also an indirect benefit to A, a collectivity of Philippine nationals, as then, its business B - not only becomes more viable as a going concern but also becomes equipped to funnel income to A.

Moreover, beneficial ownership need not be direct. A controlling shareholder is deemed the indirect beneficial owner of securities (e.g., shares) held by a corporation of which he or she is a controlling shareholder. Thus, in the previous illustration, A, the controlling shareholder of B, is the indirect beneficial owner of the shares in C to the extent that they are held by B.29

Nevertheless, ostensible equity ownership does not preclude unscrupulous parties' resort to devices that undermine the constitutional objective of full beneficial ownership of and effective control by Filipinos. It is at this juncture that the Grandfather Rule finds application:

Bare ownership of 60% of a corporation's shares would not suffice. What is necessary is such ownership as will ensure control of a corporation.

... [T]he Grandfather Rule may be used as a supplement to the Control Test, that is, as a further check to ensure that control and beneficial ownership of a corporation is in fact lodged in Filipinos.

For instance, Department of Justice Opinion No. 165, series of 1984, identified the following "significant indicators" or badges of "dummy status":

1. That the foreign investor provides practically all the funds for the joint investment undertaken by Filipino businessmen and their foreign partner[;]

2. That the foreign investors undertake to provide practically all the technological support for the joint venture[; and]

3. That the foreign investors, while being minority stockholders, manage the company and prepare all economic viability studies.

In instances where methods are employed to disable Filipinos from exercising control and reaping the economic benefits of an enterprise, the ostensible control vested by ownership of 60% of a corporation's capital may be pierced. Then, the Grandfather Rule allows for a further, more exacting examination of who actually controls and benefits from holding such capital.30

It is opportune that the present Petition has enabled this Court to clarify both the conception of capital, for purposes of compliance with the 1987 Constitution, and the mechanisms primarily the Control Test, and suppletorily, the Grandfather Rule through which such compliance may be assessed.

ACCORDINGLY, I vote to grant the Petition.

Footnotes

1 Gamboa v. Finance Secretary Teves, et al., 668 Phil. 1 (2011) [Per J. Carpio, En Banc].

2 Heirs of Wilson P. Gamboa v. Finance Secretary Teves, et al., 696 Phil. 276 (2012) [Per J. Carpio, En Banc].

3 CONST., art. XII, secs. 2, 10, 11, and art. XIV, sec. 4(2) provide:

ARTICLE XII. National Economy and Patrimony

....

SECTION 2. All lands of the public domain, waters, minerals, coal, petroleum, and other mineral oils, all forces of potential energy, fisheries, forests or timber, wildlife, flora and fauna, and other natural resources are owned by the State. With the exception of agricultural lands, all other natural resources shall not be alienated. The exploration, development, and utilization of natural resources shall be under the full control and supervision of the State. The State may directly undertake such activities, or it may enter into co-production, joint venture, or production-sharing agreements with Filipino citizens, or corporations or associations at least sixty per centum of whose capital is owned by such citizens. Such agreements may be for a period not exceeding twenty-five years, renewable for not more than twenty-five years, and under such terms and conditions as may be provided by law. In cases of water rights for irrigation, water supply, fisheries, or industrial uses other than the development of water power, beneficial use may be the measure and limit of the grant.

....

SECTION 10. The Congress shall, upon recommendation of the economic and planning agency, when the national interest dictates, reserve to citizens of the Philippines or to corporations or associations at least sixty per centum of whose capital is owned by such citizens, or such higher percentage as Congress may prescribe, certain areas of investments. The Congress shall enact measures that will encourage the formation and operation of enterprises whose capital is wholly owned by Filipinos.

In the grant of rights, privileges, and concessions covering the national economy and patrimony, the State shall give preference to qualified Filipinos.

The State shall regulate and exercise authority over foreign investments within its national jurisdiction and in accordance with its national goals and priorities.

SECTION 11. No franchise, certificate, or any other form of authorization for the operation of a public utility shall be granted except to citizens of the Philippines or to corporations or associations organized under the laws of the Philippines at least sixty per centum of whose capital is owned by such citizens, nor shall such franchise, certificate, or authorization be exclusive in character or for a longer period than fifty years. Neither shall any such franchise or right be granted except under the condition that it shall be subject to amendment, alteration, or repeal by the Congress when the common good so requires. The State shall encourage equity participation in public utilities by the general public. The participation of foreign investors in the governing body of any public utility enterprise shall be limited to their proportionate share in its capital, and all the executive and managing officers of such corporation or association must be citizens of the Philippines.

....

ARTICLE XIV. Education, Science and Technology, Arts, Culture, and Sports

....

SECTION 4....

(2) Educational institutions, other than those established by religious groups and mission boards, shall be owned solely by citizens of the Philippines or corporations or associations at least sixty per centum of the capital of which is owned by such citizens. The Congress may, however, require increased Filipino equity participation in all educational institutions[.] (Emphasis supplied)

4 Heirs of Wilson P. Gamboa v. Finance Secretary Teves, et al., 696 Phil. 776, 341 (2012) [Per J. Carpio, En Banc].

5 Gamboa v. Finance Secretary Teves, et al., 668 Phil. 1, 69-70 (2011) [Per J. Carpio, En Banc]. This definition, stated in a fallo, was noted in my April 21, 2014 Dissent in Narra Nickel Mining and Development Corp., et al. v. Redmont Consolidated Mines Corp., 733 Phil. 365, 420 (2014) [Per J. Velasco, Jr., Third Division]. This, however, was not the pivotal point in that Opinion.

6 Heirs of Wilson P Gamboa v. Finance Secretary Teves, et al., 696 Phil. 276, 341 (2012) [Per J. Carpio, En Banc]. The Court stated, "[s]ince a specific class of shares may have rights and privileges or restrictions different from the rest of the shares in a corporation, the 60-40 ownership requirement in favor of Filipino citizens in Section 11, Article XII of the Constitution must apply not only to shares with voting rights but also to shares without voting rights. Preferred shares, denied the right to vote in the election of directors, are anyway still entitled to vote on the eight specific corporate matters mentioned above. Thus, if a corporation, engaged in a partially nationalized industry, issues a mixture of common and preferred non-voting shares, at least 60 percent of the common shares and at least 60 percent of the preferred non-voting shares must be owned by Filipinos. Of course, if a corporation issues only a single class of shares, at least 60 percent of such shares must necessarily be owned by Filipinos. In short, the 60-40 ownership requirement in favor of Filipino citizens must apply separately to each class of shares, whether common, preferred non-voting, preferred voting or any other class of shares. This uniform application of the 60-40 ownership requirement in favor of Filipino citizens clearly breathes life to the constitutional command that the ownership and operation of public utilities shall be reserved exclusively to corporations at least 60 percent of whose capital is Filipino-owned. Applying uniformly the 60-40 ownership requirement in favor of Filipino citizens to each class of shares, regardless of differences in voting rights, privileges and restrictions, guarantees effective Filipino control of public utilities, as mandated by the Constitution."

7 Id. at 363.

8 589 Phil. 387 (2008) [Per J. Carpio Morales, En Banc].

9 G.R. No. 204819, April 8, 2014, 721 SCRA 146 [Per J. Mendoza, En Banc].

10 727 Phil. 28 (2014) [Per J. Abad, En Banc].

11 Province of North Cotabato, et al. v. Government of the Republic of the Philippines Peace Panel on Ancestral Domain (GRP), et al., 589 Phil. 387 (2008) [Per J. Carpio Morales, En Banc].

12 CONST., preamble.

13 CONST., art. II, sec. 19.

14 J. Mendoza, Dissenting Opinion, p. 21.

15 Id.

16 CORP. CODE, sec. 6, par. 1 provides:

Section 6. Classification of shares. - The shares of stock of stock corporations may be divided into classes or series of shares, or both, any of which classes or series of shares may have such rights, privileges or restrictions as may be stated in the articles of incorporation: Provided, That no share may be deprived of voting rights except those classified and issued as "preferred" or "redeemable" shares, unless otherwise provided in this Code: Provided, further, That there shall always be a class or series of shares which have complete voting rights. Any or all of the shares or series of shares may have a par value or have no par value as may he provided for in the articles of incorporation: Provided, however, That banks, trust companies, insurance companies, public utilities, and building and loan associations shall not be permitted to issue no-par value shares of stock. (Emphasis supplied)

17 J. Leonen, Dissenting Opinion in Narra Nickel Mining and Development Corp., et al. v. Redmont Consolidated Mines Corp., 733 Phil. 365, 420 (2014) [Per J. Velasco, Jr., Third Division].

18 J. Mendoza, Dissenting Opinion, p. 14.

19 Id. at 16.

20 J. Leonen, Dissenting Opinion in Narra Nickel Mining and Development Corp., et al. v. Redmont Consolidated Mines Corp., 733 Phil. 365, 475 (2014) [Per J. Velasco, Jr., Third Division].

21 SECURITIES CODE, Revised Implementing Rules and Regulations (2011), Rule 3(1)(A) provides:

Rules 3 - Definition of Terms

1....

A. Beneficial owner or beneficial ownership means any person who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, has or shares voting power (which includes the power to vote or direct the voting of such security) and/or investment returns or power (which includes the power to dispose of, or direct the disposition of such security)[.]

22 J. Leonen, Dissenting Opinion in Narra Nickel Mining and Development Corp. v. Redmont Consolidated Mines Corp., G.R. No. 195580, January 28, 2015, 748 SCRA 455, 492 [Per J. Velasco, Jr., Special Third Division].

23 J. Leonen, Dissenting Opinion in Narra Nickel Mining and Development Corp. et al. v. Redmont Consolidated Mines Corp., 733 Phil. 365, 468 (2014) [Per J. Velasco, Jr., Third Division].

24 Id. at 478.

25 Heirs of Wilson P Gamboa v. Finance Secretary Teves, et al., 696 Phil. 276, 332 (2012) [Per J. Carpio, En Banc].

26 J. Leonen, Dissenting Opinion in Narra Nickel Mining and Development Corp., et al. v. Redmont Consolidated Mines Corp., 733 Phil. 365, 467 (2014) [Per J. Velasco, Jr., Third Division].

27 Id. at 469-471, citing Gamboa v. Finance Secretary Teves, et al., 668 Phil. 1, 51, 53, and 69-71 (2011) [Per J. Carpio, En Banc].

28 Id. at 475.

29 Id. at 475-476.

30 Id. at 478-479, citing DOJ Opinion No. 165, series of 1984, p. 5.

The Lawphil Project - Arellano Law Foundation